Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Trading articles

-

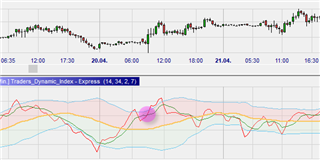

This article explains how to handle exits correctly in a simple trading system. The system used for this purpose is a robust trend following strategy, which is available in many trading platforms, so that the techniques shown here can be understood by the reader.

Today, the industry...

Read more ... -

What if there was a robust and effective way to trade on the markets? Most traders use indicators and chart patterns when trading, but recently more and more professional traders have favoured a powerful method known as the auction market theory. If you use a "covert" dimension of markets known...

Read more ... -

The D&D Range Bar Scalping strategy should get the attention of every day trader. It is one of the few trading strategies, which are...

Read more ... -

A strong market...

Read more ... -

Everybody agrees that the trend is a key factor in trading. For French trader Eric Lefort it is THE key factor. His tool is therefore capable of identifying the market trend in a more granular...

Read more ... -

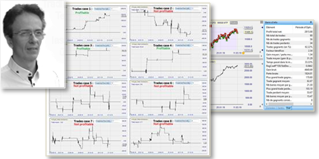

Rüdiger Born is the founder and manager of BORN Traders. He was already active in the markets in the early 1990s and trades successfully on the international stock exchanges.

...

Read more ... -

Range bars are getting more and more popular. With range bars it is not easy to estimate at what price level the next range bar will appear. The range bars viewer indicates where the next range bar will appear in your chart.

The advantages of the range bars viewer:

... Read more ... -

This book, written by William J. O'Neil, is a “modern classic” of the trading literature. Since its first publication in 1988, it has been published several times in a new, updated edition. This review refers to the 2011 version.

...

Read more ... -

Technical analysis indicators tend to have a 'standard' interpretation. Most traders simply work with this standard interpretation. As a matter of fact, most trading platforms don't even allow traders to interpret indicators in a non-standard way. But what if you think it should be interpreted...

Read more ... -

Traders like to keep an overview of their trades. The NanoTrader trading platform offers several possibilities to do so both in separate reports and directly in the charts.

1. AN OVERVIEW OF YOUR TRADES

Besides traditional trade reporting methods, the NanoTrader platform offers...

Read more ... -

Most traders have heard about Dow theory and higher highs and lower lows. This article is a quick recap of this very important trading topic.

Highs and lows are major reference points for traders. Especially in daily charts they are regarded as key points. The reason for this is their...

Read more ... -

The concept of divergence often makes its appearance when financial markets are analysed. In simple terms divergence means that the market price evolves in the opposite direction of what appears to be the direct of the market’s momentum. Divergence does not occur that often. Hence, traders, who...

Read more ... -

We have asked six professional traders what advice they would give novice traders. Every trader provided his personal top three of rules and advice ...

TRADER 1

1. Pick a time frame for your charts and stick to it. The time frame determines all...

Read more ... -

Successful trading is unthinkable without sound analysis. It takes technically and/or fundamentally conclusive setups to systematically find promising trading opportunities. Many traders use a combination of instruments, which must mutually confirm each other in order to qualify for a high...

Read more ... -

The final part of this series about day trading using moving averages shows a simple but an apparently effective day trading strategy for forex trading. This strategy uses two different moving averages. A weighted moving average (WMA) serves as trend indicator and a simple moving average (SMA)...

Read more ... -

This article introduces and explores the idea of an adaptive moving average as suggested by trader Perry J. Kaufmann. Most traders look for markets which are showing a trend. This raises the big question “when does a trend start and when does a trend end”. The answer to this question is not an...

Read more ... -

This article focuses on combinations of specific candlestick patterns and specific moving averages. Japanese candlestick patterns have become popular with traders. The patterns often have original and exotic sounding names such as ‘Evening Star’, ‘Harami Cross’ or ‘Three Soldiers’. Although...

Read more ... -

The T-Line scalping strategy uses one single chart. The time frame of the chart is in ticks. Typical for scalping the T-Line Scalping strategy focuses on speed, simplicity and precision. No need for intensive interpretation, what matters is reactivity. Using multiple targets increases the...

Read more ... -

Most traders are familiar with the Andrews Pitchfork drawing tool. The distinctive pitchfork shape definitely attracts the eye. In spite of being very recognisable few traders can draw Andrews pitchfork correctly. This article suggests one solution to draw a usable Andrews Pitchfork.

...

Read more ... -

This signal detects the periods where the market is in a horizontal trading range. Once a range has been detected, the signal will indicate when the market breaks out of the range.

The example illustrates how the signal works:

...

Read more ... -

A basic trading strategy based on simple moving averages is the moving average crossover strategy. Opinions are divided on this simple strategy with some traders saying it has proven to be unworkable whereas others seem to be more open. Those in favour defend...

Read more ... -

This series of articles focuses on public domain day trading strategies which include moving averages. The objective is not to discuss or compare the different types of moving averages and their respective merits, but to take a closer look at their parameters...

Read more ... -

The Volume Weighted Average Price (VWAP) is exactly what the name says, the price at which all orders were executed, weighted by the order volume. In short, the prices at which the most volume was executed weigh more heavily -read are more important- in the average price calculation. The VWAP...

Read more ... -

The Pullback Scalper strategy programmed by Edin Babajic is based on the KISS principle (keep it simple stupid) concept. The strategy focuses on the U.S. market indices (Dow, S&P500, Nasdaq ...). As indicated by its name the strategy is a trend following strategy which tries to identify...

Read more ... -

This trading strategy combines the well-known Keltner channels with the concept of a pullback. A market which is in a trend but which moves in the opposite direction is said to be in a pullback. Traders expect this pullback to be only temporary and expect the market to resume its trend. Chester...

Read more ... -

Trend following is applicable to all time horizons; from day trading to swing and position trading as well as investing. It is, however, particularly successful on longer-term time frames. The basic idea is to profit from the continuation of an existing move by trading in the direction of the...

Read more ... -

One of the main criteria which makes a financial instrument interesting for active daytraders is its volatility. Volatility is essential to profitable trading. But other criteria are also important.

The majority of traders trade markets which are well-known...

Read more ... -

This oscillator, which was made popular by Linda Bradford Raschke, identifies the momentum behind market moves and highlights new momentum highs and lows.

The Elliot Oscillator is a 10-period simple moving average subtracted from a 3-period simple moving average and plotted as...

Read more ... -

The Rainbow Moving Average indicator is based on Australian trader Daryl Guppy's Rainbow indicator. The Rainbow Moving Average indicator consists of 22 exponential moving averages (EMA) ranging from 9-period up to 100-period EMAs. These 22 EMAs are plotted on the price chart using the full...

Read more ... -

Daryl Guppy is an Australian trader who developed a “rainbow” of multiple moving averages, called the Guppy Multiple Moving Averages (GMMA) but often referred to as Guppy's Rainbow.

The GMMA indicator consists of three groups of exponential moving averages (EMA). There...

Read more ... -

The Hikkake pattern was first described by Daniel L. Chesler and is used to identify possible market reversal points. An Hikkake pattern consists of two candles.

...

Read more ... -

The one day reversal pattern was defined by the well-known trader Jesse Livermore, who considers it a strong signal. As the name implies this pattern is used on day charts.

...

Read more ... -

The importance of trading in the direction of the trend is drilled into novice day traders and quite rightly so. When going with the flow, the timing of the entry becomes less important as the probability of being postioned in the right direction is higher. Nevertheless, trading against the...

Read more ...

Pages

- « first

- ‹ previous

- 1

- 2

- 3