Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

The Hikkake pattern – Daniel L. Chesler

The Hikkake pattern was first described by Daniel L. Chesler and is used to identify possible market reversal points. An Hikkake pattern consists of two candles.

The Hikkake pattern

The first candle must always be an inside candle. An inside candle is a candle which is smaller than the previous candle. It lies 'inside' the previous candle.

In the case of a short sell signal (bearish Hikkake) the second candle should have a higher high and higher low than the inside candle. In the case of a long signal (bullish Hikkake) the second candle needs to have a lower low and a lower high than the inside candle.

Opening a position

In order to buy a position when a long signal appears, a stop buy order is placed on the high of the first candle in the pattern. In order to open a short position when a signal appears, a stop sell order is placed on the low of the first candle in the pattern.

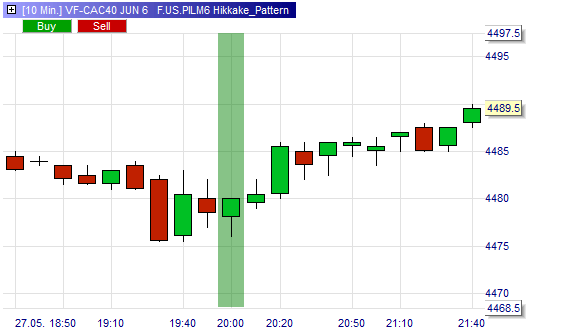

This example shows a buy signal (bullish Hikkake). Notice the inside candle and the lower low and the lower high of the signal candle.

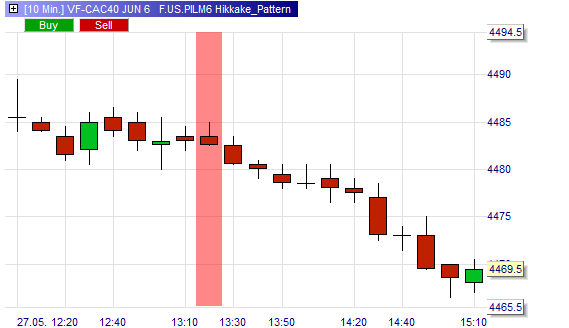

This example shows a short sell signal (bearish Hikkake). Notice the inside candle and the higher high and the higher low of the signal candle.

Recommended broker

People also read

- The One Day Reversal pattern – Jesse Livermore

- The 1-2-3-4 chart pattern

- Automatically detecting chart patterns

Recommended managed account service