Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

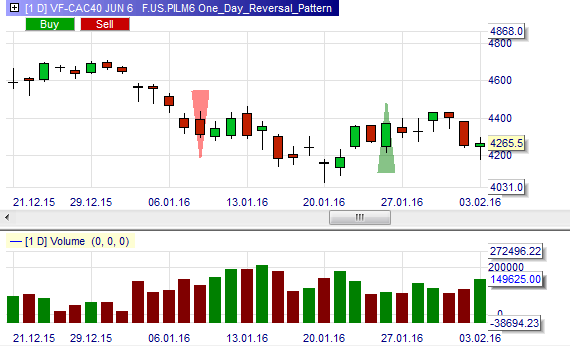

The One Day Reversal pattern – Jesse Livermore

The one day reversal pattern was defined by the well-known trader Jesse Livermore, who considers it a strong signal. As the name implies this pattern is used on day charts.

A one day reversal long pattern occurs when the low of the candle is lower than the low of the previous candle, but the close of the candle is above the close of the previous candle. A one day reversal short pattern occurs when the high of the candle is higher than the high of the previous candle, but the close of the candle is below the close of the previous candle.

Jesse Livermore often used the volume indicator (only available for exchange traded instruments) as confirmation. When a one day reversal pattern occurs, the order volume corresponding to the signal candle must be higher than the previous day's order volume.

This example shows both a short sell signal and a buy signal. Jesse Livermore would reject the short sell signal because the volume corresponding to the signal candle is lower than the previous day's volume.

People also read

Recommended broker