Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

VWAP and TWAP, a basis for trading strategies

The Volume Weighted Average Price (VWAP) is exactly what the name says, the price at which all orders were executed, weighted by the order volume. In short, the prices at which the most volume was executed weigh more heavily -read are more important- in the average price calculation. The VWAP can be calculated over different horizons. This article focuses on using the VWAP for day trading but the package also contains weekly, monthly, quarterly, yearly and rolling VWAPs.

The VWAP can only be calculated for markets such as the futures markets which publish their order volume. The package also includes the Time Weighted Average Price (TWAP). The TWAP is a similar concept but it can be used for instruments such as CFD or forex for which order volume is not available.

| Suitable for | : Market indices, forex, stocks, commodities |

| Instruments | : Futures, CFD, forex and stocks |

| Trading type | : Day trading and swing trading |

| Trading tempo | : 1-3 Signals per day when day trading |

| Using NanoTrader | : Manual |

THE VWAP IN DETAIL

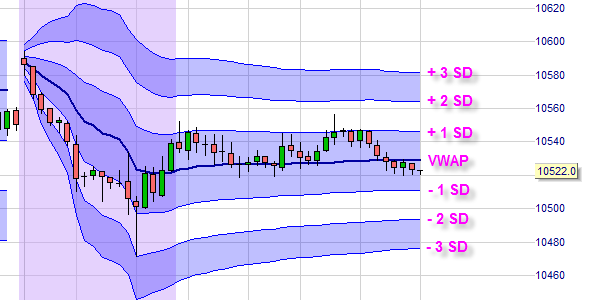

The VWAP is an anchored moving average. It can be anchored at the start of the day, week, month, quarter or year. The first, second and third standard deviations (SD) of the VWAP are used to create the bands.

If trade prices are normally distributed ...

about 68.2% of all trades lie between the -1 SD and +1 SD and,

about 95.4% of all trades lie between the -2 SD and +2 SD.

Traders mainly use three aspects of the VWAP for opening and managing positions

1. Yesterday’s VWAP levels are today’s support and resistance levels.

2. Today’s VWAP.

3. The two second SD of today’s VWAP are resistance and support levels.

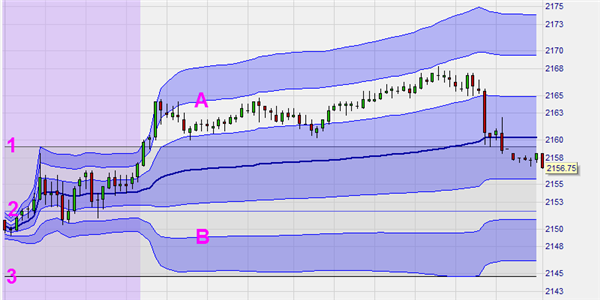

This example shows yesterday’s VWAP levels (horizontal lines 1, 2 and 3), today’s VWAP (blue central line) and today’s second SD levels (A and B) on a 5-minute chart.

The VWAP cannot be used immediately when the market opens as it is calculated on the basis of order volume! Depending on order volume, traders can start using the VWAP after 1 to 2 hours. The purple chart background indicates 1 ½ hour so when it finishes the VWAP is (nearly) ready for use.

Using the VWAP and trade examples

Traders focus on the three aspects of the VWAP explained in the following way:

Yesterday’s VWAP lines can always be considered support or resistance.

Today’s blue VWAP line is support on a bullish day and resistance on a bearish day. Determining if it is a bullish or a bearish day can be done, for example, by using the Weekly VWAP.

The second standard deviation is an important level. With the exception of strong trading days, the market price will not stay above (below) the outer deviation level for a long time. In the example above, which is a strong market day, you can see the market price going outside the second standard deviation, returing back in the band quickly and then staying in the band for a long time.

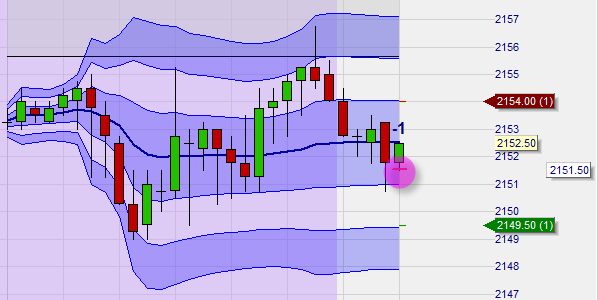

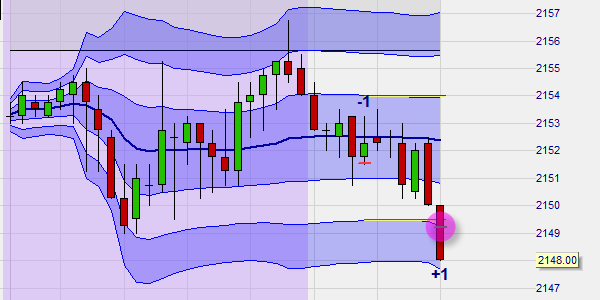

This example shows a bearish day on the mini SP500 future. The market is below yesterday’s VWAP levels and on the Weekly VWAP (not visible here) the market price is below the VWAP. On this 10-minute chart the candle just closed below today’s VWAP and the trader opened a short position at 2151,50. He placed a stop at 2154. His profit target is placed at 2149,50 which is the outer band of the second SD.

Tip: The most efficient way to place the stop and target orders in the NanoTrader platform (free demo) is to insert a „click stop“ and a „click target“ via the Designer dialog and activate the TradeGuard. Once the position is opened, your stop and target orders are placed automatically. By clicking on the little arrow in front of the order label, you can drag the orders to the price levels you want.

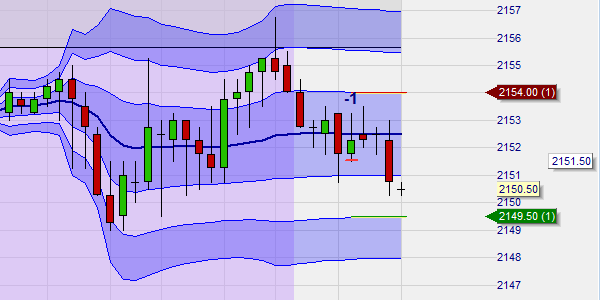

This example is the second phase of the trade shown above. After some hesitation around the VWAP level, the market has gone down.

This example is the third and final phase of the trade on the SP500 shown above. The target was reached and the short position closed with a profit.

It is worth noting that although the market started fairly strong earlier in the day, this trader was not lured into buying a long position. With the market price below both the Weekly VWAP and below all yesterday’s VWAP levels, he correctly indentified a bearish market and focused on identifying a short sell opportunity.

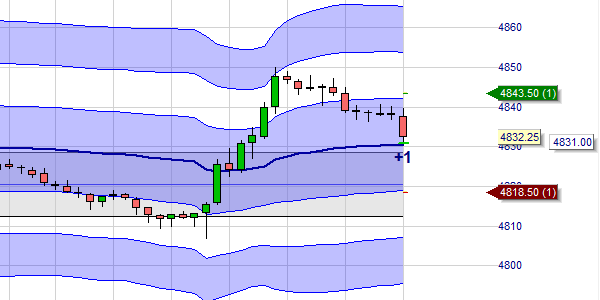

The second example of a trade, shows a bullish day on the mini NASDAQ100 future. The market is trading above yesterday’s VWAP levels (not visible). On this 5-minute chart the market pulled back to today´s VWAP and the trader bought a long position at 4831. He placed a stop at 4118,50. His profit target is placed at 4843,50 which is just above the first SD.

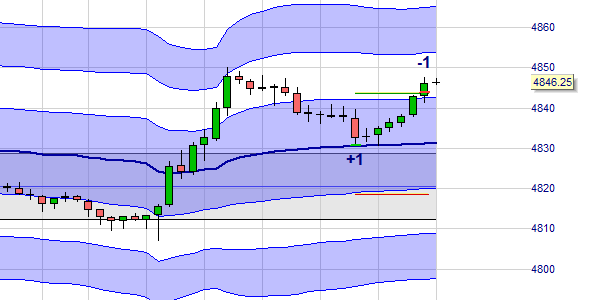

This example is the final phase of the same trade. The profit target was reached and the position sold with a profit.

Is the market bullish or bearish?

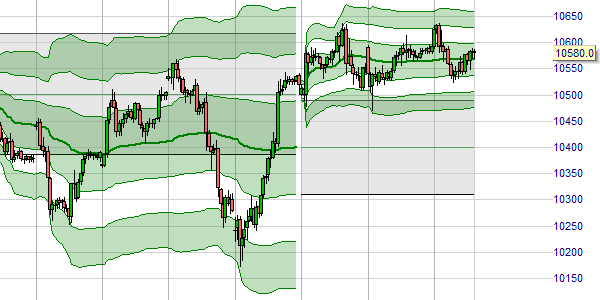

Below are the VWAPs in higher time frames. Day Traders also use the weekly VWAP to determine at the start of a day if the market is bullish or bearish.

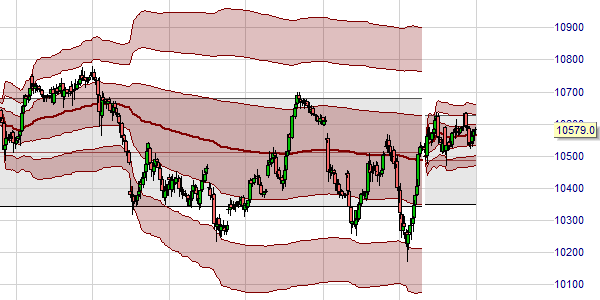

This is the weekly VWAP.

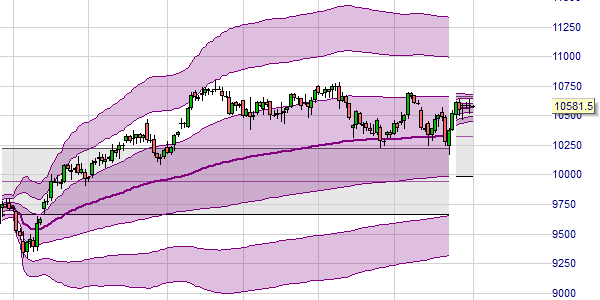

This is the monthly VWAP.

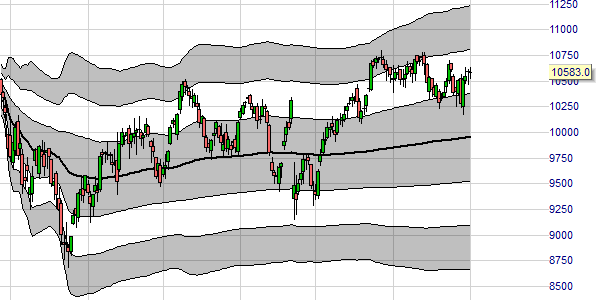

This is the quarterly VWAP.

This is the yearly VWAP.

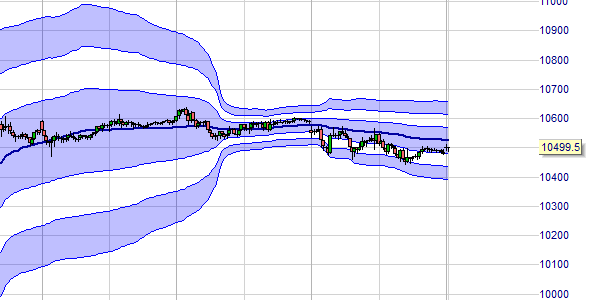

And this is the rolling VWAP.

People also read

Volume profile... key price levels

Feedback from NanoTrader users...

„The NanoTrader platform is magnificent. “ – Kai

„NanoTrader is my fourth trading platform and it is by far the BEST the best platform." – Heinz

„I have already familiarized myself a little bit with the platform and I can tell you, that it is the best trading platform I have ever used.” – Peter

If you are looking for a good managed account, consider this service...