Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

T-Line Scalping, a trading strategy

The T-Line scalping strategy uses one single chart. The time frame of the chart is in ticks. Typical for scalping the T-Line Scalping strategy focuses on speed, simplicity and precision. No need for intensive interpretation, what matters is reactivity. Using multiple targets increases the profitability per trade.

- Suitable for: Market indices (DOW, S&P 500, DAX ...) and Forex pairs

- Instruments: Futures, CFD and Forex

- Trading type: Scalping and day trading

- Trading tempo: Numerous signals every day

- Implementation: Manual or (semi-)automated using NanoTrader

The T-Line Scalping strategy in detail

The T-Line Scalping strategy uses one single chart. The chart is configured as a Heikin-Ashi chart. The time frame of the chart is set by default to 5 ticks but traders can opt for 8, 13 or 21 ticks.

The strategy incorporates a trend filter. The trend filter combines an exponential moving average calculated over 8 periods and a classic moving average calculated over 20 periods. The background of the chart is green when the trend is positive and red when the trend is negative.

The T-Line Scalping strategy uses multiple profit targets in an attempt to maximalise the profitability of each trade.

When to open a position?

When the trend is positive (green background) and the first Heikin Ashi candle closes above the exponential moving average 2 futures (or other instruments) are bought. Traders willing to take more risk could buy 4 futures.

When the trend is negative (red background) and the first Heikin Ashi candle closes below the exponential moving average 2 futures (or other instruments) are sold short. Some scalpers using the T-Line Scalping strategy trade both buy and short sell signals. Other scalpers trade only buy or short sell signals depending on the direction of the main day’s trend.

This example shows a buy signal. The trader opened a long position of 2 contracts.

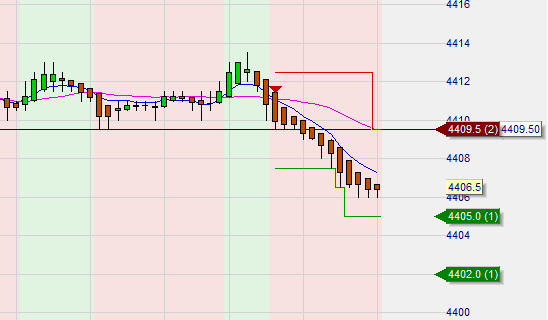

This example shows a short sell signal. The trader opened a short sell position of 4 contracts.

When to close a position?

The T-Line scalping strategy works with multiple profit targets and a single stop. Both targets and the stop or based on the average true range (ATR). The ATR indicates an instrument’s volatility. When volatility is high, both stop and targets will be further away from the entry price compared to moments when volatility is low(er).

The number of profit targets depends on the size of the position. A position of 2 futures implies 2 profit targets. A position of 4 futures implies 4 profit targets. The profit targets are 2x and 3x the ATR for a 2-future position and 2x, 3x, 5x and 8x the ATR for a 4-future position. The stop is placed at the entry price minus (plus, for short positions) 3x the ATR.

Placing the stop loss order and the profit target orders must be done immediately when the position is opened. The strategy can only be properly applied by using the NanoTrader as the platform can automatically place all orders and manage numerous profit targets.

This example shows a short sell position of 4 contracts. The first target was reached and 1 contract sold with a profit. The trader is still long 3 contracts with 3 remaining profit targets and the stop loss automatically adjusted to 3 lots.

This example shows the same position as above. The second profit target has been reached. 2 lots and 2 targets remain. Also notice that the trader has dragged his stop order to the level of his entry price. From this point on he can no longer lose money on the position.

Did you know? Open orders can be changed by clicking the triangle in front of the order label and dragging the order to the desired price level.

This example shows a long position. The first profit target was never reached. The stop was reached and the position was closed with a loss.

Conclusion

A good scalping technique must be accurate (not much time to think), simple (preferably visual) and fast (small profits require more trades). The number of losing trades must be reduced to a minimum. The T-Line scalping strategy attempts to meet all these criteria.

People also read

DAX or DOW with the D&D trading strategy