Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

News

Improve your trading strategies

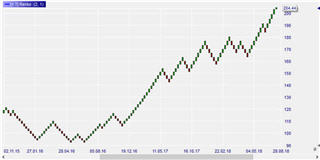

For French trader Eric Lefort identifying the market trend 100% correctly is THE key. His Mogalef tool is therefore capable of identifying no less than eight different market trends.Eric goes way beyond the traditional bullish, bearish, sideways. Interesting stuff.

Tools for volume-based trading

Volume Profile, Time Price Opportunities, Volume Viewer... all these tools used by volume traders are described in a practical and to the point way.

A short explanation of Renko charts

The Renko charts are used to illustrate the importance of movement-only charts. Other types of movement only charts are range bars and WL bars.

Try a free demo of the astonishing NanoTrader trading platform.

Scalping strategy for US stocks

Professional trader Wim Lievens shares his scalping / day trading strategy. Lovers of immediate trading action after the market open should look into this strategy.

More free trading strategies

The free trading strategies offer in NanoTrader has been expanded with another scalping strategy, the D&D Range Bar Scalping strategy. D&D is short for DAX and DOW. A very interesting aspect of the D&D Range Bar Scalping is its evident ability to also find trading opportunities when these markets are not volatile.

Time-based orders

Time-based orders make technology work for the trader. The trader can specify when his orders should be placed or cancelled. He does not have to sit behind his trading platform and wait.

The unbelievable Volume Viewer for futures traders

The sensational Volume Viewer shows an animation directly in the chart of the executed orders and volumes. Settings in speed and colour allow the trader to create actionable live information.

The Volume Viewer is excellent for day trading and scalping. More

Free newsletter with trading signals

Receive free daily trading signals of your choice in your mailbox. Simple use the configurator below to combine the stocks, market indices and forex pairs you are interested in, with indicators and strategies of your choice. The intelligence is provided by TechScan. The charts are magnificent and each signal also shows if there were any previous signals on the same instrument. Some impressions:

Analysing the market has become child's play. Go ahead and create your own free market newsletter by using this WH SelfInvest tool:

More trader profiles

An additional series of portraits profiling professional traders who use the NanoTrader trading platform are being added. Next is creative trader Andre Stagge.

NanoTrader shines on the World of Trading

On this year's World of Trading fair the live trading event attracted large audiences. NanoTrader appeared to be the preferred trading platform of the (professional) traders who competed in the live trading event. Four out of the five traders on the event stage use the NanoTrader for their trading.

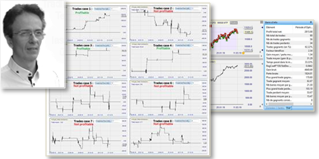

Trader profiles

We will add write-ups of the numerous professional traders who use the NanoTrader trading platform. Most of these traders provide free trading tools, signals or strategies directly in the NanoTrader or via the WH SelfInvest trading store. The first write-ups cover the following traders: René Wolfram, Birger Schäfermeier, Wim Lievens, Carsten Umland, Wieland Arlt and Eric Lefort.

New strategies – Trader André Stagge

Professional fund manager and trader André Stagge has integrated eight of his trading strategies in the NanoTrader Full trading platform. These strategies are swing trading strategies. Positions are usually kept 24 to 36 hours. In one rare case positions are kept several weeks.

André Stagge worked for a decade as a senior portfolio manager at a major German asset management company. He managed 2,5 billion Euro in clients assets and made more than 500 million Euro in profit (after costs) for his clients.

The following ready-to-use trading strategies have been added to the NanoTrader Full:

- Friday silver surfer,

- EUR-USD tax day,

- Triple witching,

- Combination of the Halloween and month’s end effects,

- Labor day long,

- Long before the Fed,

- Interest rate hamster, and

- Short superstar.

Discover new dimensions in trading... download the NanoTrader Full demo.

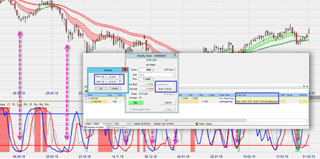

New trading tool – The range bars viewer

Range bars are getting more and more popular. With range bars it is not always easy to estimate at what price level the next range bar will appear. The range bars viewer indicates where the next range bar will appear in a chart. Another free trading tool in the NanoTrader.

Book Review – How to Make Money in Stocks

'How to make money in stocks', written by trader William J. O'Neil, is a “modern classic” of the trading literature. Since its first publication in 1988, it has been published several times in a new, updated edition. This review refers to the 2011 version.

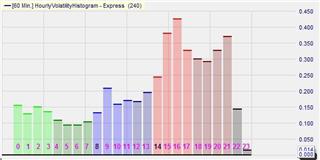

New home page section: Make volatility visible.

What is the best time to trade? The HVH (Hourly Volatility Histogram) provides the answer. It calculates and visualises the hourly volatility for each market. The most volatile times of the day, are the most interesting for traders.

New home page section: Boom! The Bollinger Volatility Explosion.

A new section has been added to the website. The section covers the advantages of the Bollinger Volatility Explosion and how it is used in daily trading. Several trade examples are illustrated and explained.

John Bollinger, the creator of the Bollinger Bands, states that periods of low volatility are often followed by periods of high volatility. John Bollinger further states that a "volatility explosion" is an opportunity for traders.

Live trading table integrated

A sample SignalRader table has been integrated in the website. This live trading table is called Synchro. Five break-out strategies trade in the table. Boost your trading experience! Have a look at the live trading table. The full SignalRadar tool is a component of the NanoTrader trading platform. You can download a real-time NanoTrader demo.

The spectacular SignalRadar

Using state of the art technology the free SignalRadar shows live trades being executed by various trading strategies. Interesting trades and trends can be easily identified and similar trades done. The SignalRadar tables contain over 500 instruments, including all major stocks, traded by more than 10 famous trading strategies. The live trades are also visible in the charts.

SignalRadar is extremely easy to use. One click to open tables, one click to see trades in charts, one click to order.

Benfits for active investors

SignalRadar is free and offers major benefits.

- Find live trades which are doing well and jump on.

- See for every market if strategies are long, short or flat.

- Identify the main market trends easily.

- Observe professional traders and strategies.

- Trade based on logic, not on feeling.

- Improve your trading skills.

- Enjoy your trading.

Install the free SignalRadar app:

New trader proposal: ADR Target Bands

A new trading tool proposed by clients has been added to the trading platform. The ADR Target bands are price target ranges based on the average daily range (ADR) of a market calculated over two different periods. The advantages of the ADR Target Bands:

- They can be used on all instruments and in all time frames.

- They are easy to understand.

- They calculate targets for the market price and thus can be used as stops and targets.

- They can be used as trading signals to open a position.

Test NanoTrader Full: free real-time demo.

Market structure points

Market structure points are important chart patterns, which every trader should keep an eye on:

- They indicate key reversal moments.

- They are easy to identify, can be used in all time frames and on all instruments.

- They can be used in most trading strategies.

- They are a good tool to learn how to trade.

In NanoTrader this chart pattern is detected automatically. The signal is ready to give real-time trading signals.