Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

A powerful scalping strategy

The D&D Range Bar Scalping strategy is designed for scalping two of the world’s major market indices. The strategy is based on four very solid principles.

- Range bars are used to find scalping opportunities, even when the market is not volatile.

- Positions are only opened in the direction of the trend.

- Positions are only opened when the market breaks out of a range.

- Positions are managed with multiple profit targets in order to maximize profit.

The D&D Range Bar Scalping strategy

1. DAX, and DOW and Range bars

I must confess that I am seduced by the D&D strategy offered by WH SelfInvest to the point of having included it on my Automated Strategies Cloud. From my point of view, it is a strategy that offers a solution to the problem of the persistence of low volatility on international indices over the last 2 to 3 years. Indeed, when volatility is low, the earning potential decreases and strategies that have performed well in the past years may simply no longer be profitable.

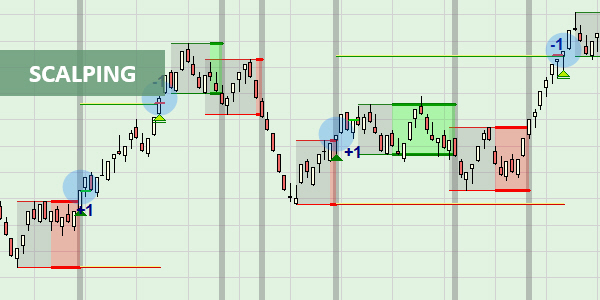

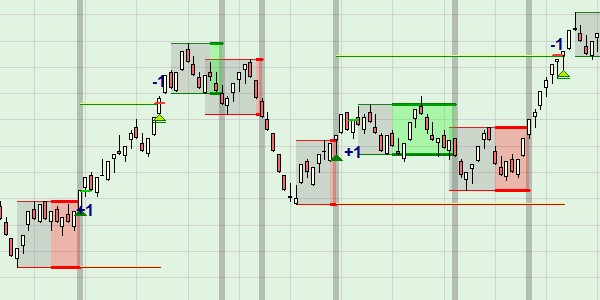

The name of the D&D strategy refers to the D of the Dax and the Dow Jones. It operates in an unusual environment, that of the Range Bar charts (also called absolute range charts). The Range Bar chart has an important part in the success of the D&D strategy. Indeed, it is independent of time and only reacts to price movements. Concretely, if the price remains fixed for several minutes, there are no new candlesticks. On the other hand, if the price accelerates, the chart produces a succession of candlesticks as below during the first trade (entry +1 and exit -1) as well as during the final acceleration which closes the second trade.

The signals are based on the above horizontal ranges that characterize the consolidation phases. When the price moves out of a range, there is usually an opportunity to move into position in the direction of the crossing. Other advantages of the strategy include a trend indicator that automatically filters out signals and colours the background green when it rises or red when it falls.

There's a lot to learn about this strategy that I've been processing in automatic mode on the future Dax since the end of last year. The D&D strategy which has unique features is available for free in the NanoTrader Full platform for WHS customers.

2. A strategy that likes movement

The D&D strategy continues to surprise by its effectiveness. This week, the fear caused by the Corona virus has somewhat awakened volatility in the financial markets. The Dax index has thus fallen by 3% since it closed last Friday. This gave me the opportunity to verify once again that this strategy was effective in exploiting market movements. During this week, it generated €445 for a Mini Dax future contract which was processed in automatic mode on the 9am-12am interval.

As a reminder, the name of the D&D strategy refers to the D of the Dax and the Dow Jones. It is a strategy that I have been working on the future Dax in automatic mode for a few weeks with good results. This week, I tried it on the future Mini Dax contract to see if it was as efficient as on the future Dax. It was the case, as you can see in this extract of the daily net profit. Note that there were no trades on Wednesday because the market was not very volatile.

It is always interesting to analyze what is positive or negative in a strategy. As can be seen below, on Monday 27/1, we started with two losses, which reminds us that when the market moves sideways, it is difficult to win. The first short trade was excellent ... except that it just missed 2 points to close with a profit. Instead, we lost. The second trade is typical of a lack of momentum that produces losses. The market didn't have the strength to hit the target... we lost. A market without movement leads to losses even with the D&D strategy!

Fortunately, there were enough winning signals to straighten the bar. Notably, when the market started to decline in the late morning. The D&D strategy detects consolidation phases and allows to enter in position when the market resumes its progression as below. Each position is automatically protected by a stop positioned at the top edge of the range and a target positioned at the risk.

Of course, not all signals of the D&D strategy are winners and not every day is a winner. On the other hand, when there are trends, the D&D strategy detects them and allows us to enter and exit the market quickly, often with a profit. This is one of its great strengths and this is due in large part to the quality of the signals. The D&D strategy is available in the NanoTrader platform offered by WH SelfInvest.

3. The D&D Range Bar Scalper strategy is performing in the midst of a major market downturn

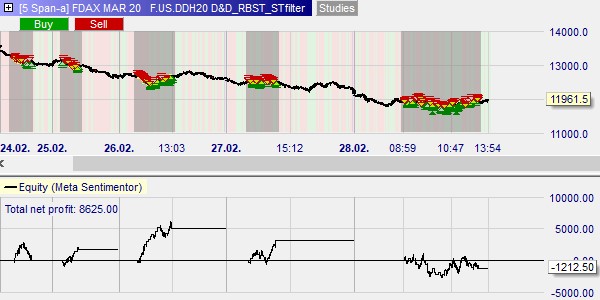

This week has been marked by the return of volatility in the financial markets. The future Dax has lost about 12% since its peak last Thursday. Against this backdrop, one may wonder how the D&D Range Bar Scalper strategy performed, since it showed good performance when volatility was low. At the end of a very volatile week, this strategy continued to surprise us, producing its best results since last November.

Presented as a solution to thrive in times of low volatility, the D&D Range Bar Scalper strategy has exploited the large declines that have exploded volatility this week. It is designed to trade in the direction of the trend. However, this week, the Dax index was mostly trending downward. It is therefore not illogical that the D&D Range Bar Scalper strategy was able to exploit these bearish phases.

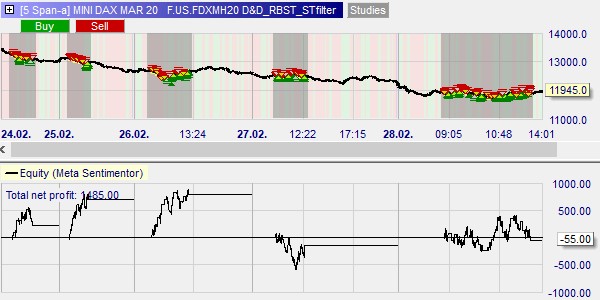

If we analyse the equity curve of the future Dax during the week below, it shows a profit of €8625, consisting of three winning days, against a losing day and a null day. It can be noted that the total profit on Wednesday 26th February reached a record level of €5000, which had never been seen since we started dealing with this strategy last November.

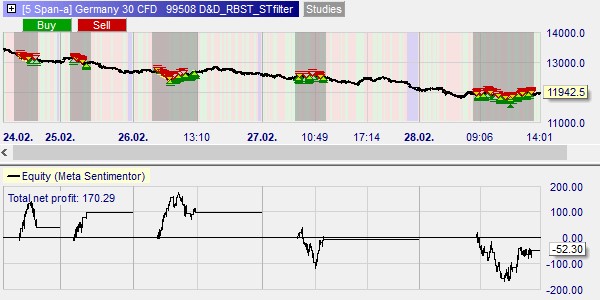

It is interesting to note that the strategy has also performed well on the future Mini Dax and on the CFD Germany 30 as can be seen below.

What this week has shown is that when the Dax moves, the D&D Range Bar Scalper strategy can capture a lot of good moves. If volatility is back in a sustainable way, this will be good news for D&D Range Bar Scalper users.

Two other pieces of good news will be of interest to traders who are trading this strategy in automatic mode. The first good news is that the Safety Net filter, which was only available to futures traders, is now also available to CFD traders. The second good news is that a new feature has been added to the Safety Net filter: Conditional Profit Protection.

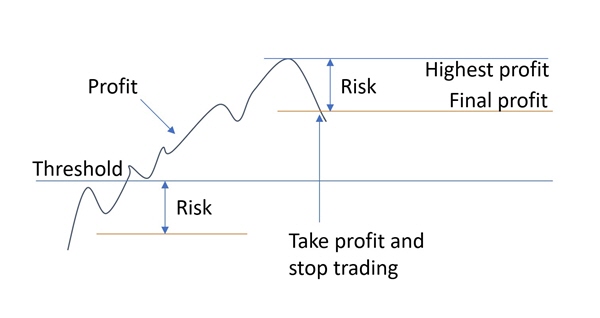

Remember that the Safety Net filter is only used in automatic mode. It allows you to manage your positions during the day in relation to the evolution of the cumulative result. In concrete terms, for a given instrument, you can define conditions for exiting a position and stopping trading for the day. For example, setting a profit target and/or a loss limit.

It is now also possible to define conditional profit protection. In practice, a profit threshold and a risk are defined. If the profit reaches the threshold, the conditional protection is activated in the form of a trailing stop equal to the risk. As long as the profit rises, trading continues. If the accumulated profit declines by more than the risk, the position is closed and trading stops.