Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Know your Return Risk Ratio (RRR)

RRR stands for Return/Risk Ratio. Traders often say "the risk return ratio", but the correct why of calculating is to divided the potential return by the risk. In other words, simply divide the potential profit by the potential loss. If, for example, the objective is to win 100 € at a risk of 20 € then the RRR is 5 (= 100/20).

In the NanoTrader platform the RRR is available before you open the position. When the position is open you also see the your RRR. If you change the price level of your profit target or stop loss, the RRR is automatically recalculated and displayed.

A hard and fast rule is to never enter into a trade if the RRR is not at least 2. Smaller RRRs are acceptable in certain types of trading and in trading strategies which have a high number of winning trades (e.g. scalping strategies).

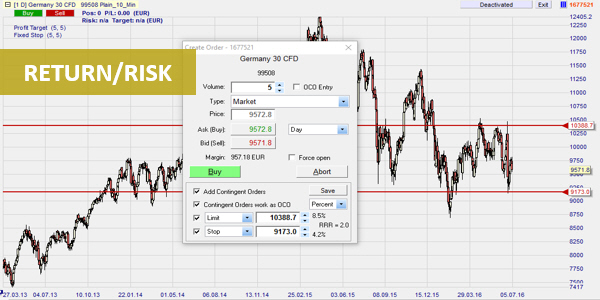

The Return/Risk ratio

The RRR before opening a position

In the NanoTrader platform the RRR is visible in the order ticket. It is obviously necessary to select contingent orders as the sell limit is the potential profit and sell the stop the potential loss.

In this example the trader wants to buy at the market price (currently 9398,5). His target is 9468 (i.e. a return of +69,5 points or +0,7%). His stop is 9373 (i.e.a risk of -25,5 points or -0,3%). Therefore his return/risk ratio is 2,7 (= 69,5/25,5).

Tip: Traders who base their target and stop orders on key points in the charts can grab the red order lines and slide them to the desired levels in the chart. The RRR in the order ticket will automatically change when sliding the orders.

Tip: Contingent orders on futures are not possible. Futures traders can use the Tradeguard to bracket their positions with a limit and a stop order.

The RRR when the position is open

The RRR on an open position is visible in the account. The RRR will change if, for example, the trader raises his stop or his target. The potential risk (PotRisk) and the potential profit (PotProfit) are shown in money terms (very useful).

In this example the RRR is 2,04. The trader is currently making a profit of 14,60 € on a target of 79,90 €.

People also read

- DAX or DOW with the D&D trading strategy?

- Trading volatility with the Eurex VSTOXX future

- Trading the DAX with J. Welles Wilder's Parabolic SAR