Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

How to increase your profits

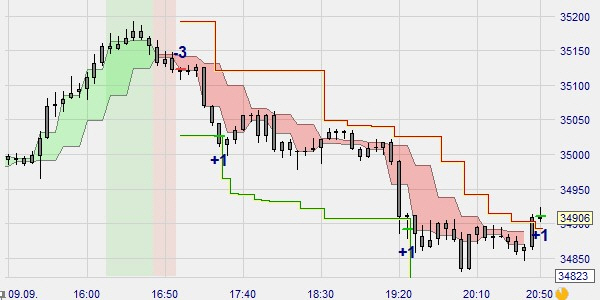

The Black Candles strategy is a very effective strategy to trade the Mini Dow Future. In the example below the strategy was able to detect and exploit a trend reversal. Detecting this quality entry is not easy.... but getting the maximum profit possible is even more difficult! The optimal solution is the multi-stop&target tool in the NanoTrader platform. Let's discover what the multi-stop/target device is and what its interest is for day traders and scalpers.

Automated trading

The above trade was managed automatically from start to finish. The opening of the position was triggered by the appearance of a bearish Black Candles signal. One of the great advantages of automated trading is that you don't have to stay in front of your screen for hours. In practice, you set a trap and come back later to see what you caught! It saves time and stress!

Single position trading

This style of position management is common. It is particularly practiced by scalpers who operate in small aggregations in order to find trends that they exploit by a succession of small-sized trades. For day traders, the stakes are different. Ideally, they are looking to profit from the major trend reversal of the day, as in the example above. However, this reversal, if it occurs, may offer a potentially large profit that a single target cannot capture in its entirety.

Trading with multiple positions

This style of position management is particularly recommended for day traders who seek to exploit the profit potential of their signals to the maximum. Following a trend reversal signal, the day trader does not know the amplitude of the upcoming movement. Hence, the interest of splitting his position, for example if it is 3 lots, into 3 positions of 1 lot each, then assigning to each position a target that is further away in order to capture large movements.

Increasing your profits

Managing multiple positions means diversifying your positions in order to earn more. In our example, the market makes a bearish move which allows us to take a 100-point profit thanks to the first target and a 240-point profit thanks to the second target. The third target is not reached and the remaining position is automatically closed by the Flat filter with a profit of 220 points. The total profit per lot is 186.7 points, a clear increase from the initial profit of 100 points. Note that the targets of the Black Candles strategy are mobile: they move away according to the market advance, which allows us to earn more!

Risk management

In this example, we can observe the unique properties of the Black Candles stop. First, it is positioned on the high point that preceded the signal. The difference between the stop and the entry price is called the initial risk. Secondly, the stop remains fixed as long as the market does not fall by more than one time the initial risk. This allows the market to breathe and wait for a real market decline, without being stopped too quickly. As soon as the market falls by more than one time the initial risk, the stop is positioned on the entry price. At that moment, you can't lose any more. Then, the more the market falls, the more the stop goes down following the market or more exactly the pink Black Candles band. This allows us to protect the gains in progress and be in a favourable position to capture big movements. Given the risks taken, the day trader has every interest in making his trade last in order to take the maximum profit.

Conclusion

The multi-stop&target device is essential for day traders who automate the management of their positions, if they have the ambition to increase their profits. With a single target, one can only win if the target is hit. If the target is too far away, you can lose or win. If the target is too close, there is a risk of generating too many trades that you don't know if they will be profitable overall. The combination of the Black Candles signal and the multi-stop/target device is an efficient solution to increase profits because it allows you to position several dynamic targets in order to capture as much movement as possible while controlling risks and securing gains.

People also read...

“Every trader has strengths and weakness. Some are good holders of winners, but may hold their losers a little too long. Others may cut their winners a little short, but are quick to take their losses. As long as you stick to your own style, you get the good and bad in your own approach.”

- trader Michael Marcus