Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

News

The Rainbow Moving Average

Use one of the most versatile trend indicators consisting of 22 EMAs to identify breakouts from dynamic supports and resistances. Read more...

WL 0800 Range Break-out

Make yourself independent of the time unit and use the WL bars with the Range Break-out. Read more...

Choose the perfect entry point for trading stocks

Choose the perfect entry point for your trade and maximize your winning trades. Use the R3 trading strategy. Read more...

Trading carbon emissions

Discover carbons emissions trading, carbon credits etc. in this new article. More...

Two new articles on volatility

These two new articles are ready for you to read: "A guide to volatility trading" and "The most volatile markets"

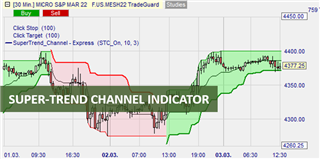

Trend Trading with the SuperTrend Channel

Recognize trends with one of the most commonly used trading strategies by short and longer term traders and learn how the SuperTrend Channel indicator works. Read more...

Successful risk management with the Drawdown Trading Tool

Optimize your risk management with the Drawdown Trading Tool and determine the potential risk of your assets. Read more...

How to apply trend and momentum trading

Use three of the most effective technical indicators and apply the concept of trend and momentum trading with the Trio Trading-Strategy. Read more...

Market movements of the night with the Night Rider Trading Strategy

Profit from the biggest market moves after the market closes using the simple Night Rider Trading-Strategy on the S&P 500. Read more...

Create a Black Candles strategy on the Dow!

Read in the following article how to create a Black Candles strategy with the NanoTrader trading platform from WH SelfInvest from scratch. Read more...

Place trades every minute with ease

Place trades every minute and let the 1-Minute Breaks trading-strategy give you many matching signals on all instruments. Read more...

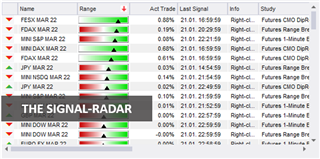

Select the right trades with the SignalRadar

SignalRadar helps traders identify the most profitable and general market trends in real time and convert them into live trades. Learn about the features of Signal Radar and read about the details of this unique tool. Read more...

Efficient Crypto Futures Trading

The rise of crypto futures is due to many factors and marks the beginning of a new mainstream crypto futures trading trend. Read about how to trade crypto futures comfortably. Read more...

Gold price market effect easy to trade

Profit from a recurring weakness in the gold price with the Gold Dumper Trading-Strategy and thus make the most of this market effect. Read more...

Use simple and universal trend indicator

An easy-to-use trend indicator, universally applicable to all instruments and all time levels, is available. Read about the Fibonacci Moving Average Trend Indicator. More...

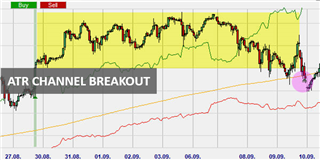

Trade Curtis Faith's trend following trading-strategy

Trend trading can be one of the most profitable trading strategies for short and long term traders. Read about a sufficient way of trading the ATR Channel Breakout trading-strategy. Mehr...

Do you trade the January Effect?

Information about the phenomenon of the January Effect and a discussion about the impact on the stock market. More...