Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Why you should care about the European banking sector index

In recent weeks, there has been talk of a possible return of inflation. This scenario seems to be supported by a rise in long-term interest rates. As short-term interest rates remain low, the spread between short-term and long-term interest rates is increasing, which greatly favours the banking sector! Indeed, banks borrow in the short term to lend in the long term. So, if the yield curve steepens, their profitability mechanically increases. In this article, we answer the question in the title, indicating which financial instruments and strategy can help active traders profit from a possible further rise in the banking sector.

Traders should explore the European banking sector futures contract

Bond markets are faltering

When investors expect inflaction, they demand higher interest rates as compensation. As bond prices vary inversely with interest rates, the fear of returning inflation has led to an immediate reaction in the bond markets.

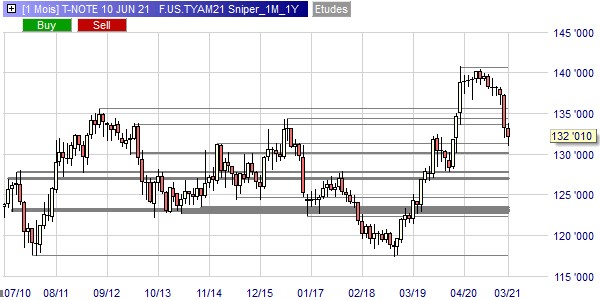

Thus, the US 10-year T-Note future, whose monthly ten-year chart is shown below, has fallen significantly since the beginning of the year. Indeed, since 2010, the 10-year T-Note future has oscillated between 117 and 140, a price range of 23 points. Now, it has just fallen by 9 points in less than a year from its high, i.e. a fall of 39.1% in relation to its range.

Financial instruments related to the European banking sector

For an active trader with a CFD or Futures account, there are several financial instruments through which he can take positions related to the European banking sector:

- iShares MSCI Europe Financials ETF CFD

- Luxor UCITS ETF Stoxx Europe 600 Banks CFD

- Future DJESBANK future

The benchmark financial instrument for trading the European banking sector is the DJESBANK future contract offered by the Eurex exchange. This future contract, which is indexed to the DJESBANK index, is very liquid as can be seen from the screenshot of its order book below.

We can see that the number of buy and sell orders is in the order of several hundred lots. On the left-hand side, we see the scrolling of the execution prices, also called Time & Sales (T&S) in the jargon. The executions are frequent and the quantities substantial. Other features of this STAR future contract are as follows:

- Tick: 0.05 points

- Value of one point: EUR 50

- Market hours: 8am - 10pm

- Expiry: monthly

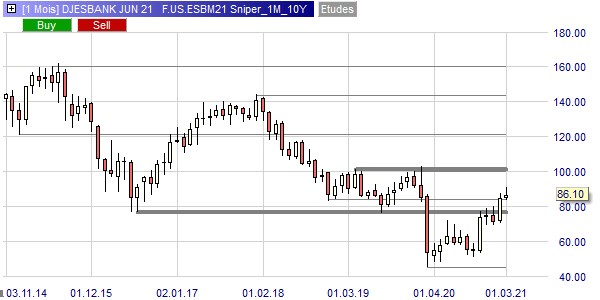

As can be seen below, the DJESBANK future is up from its lows reached during the 2020 covid crisis. It broke through solid resistance at 76, simultaneously with the 10-year T-Note future penetrating its support at 136

What strategy to adopt?

As a financial instrument, we will choose the DJESBANK future offered by Eurex for its relevance, its great liquidity, its tiny spreads and its wide time frame covering the whole European day.

But which strategy should be applied? Among the more than 74 strategies offered by WH SELFINVEST, there is a real choice! We choose a Day Trading strategy, i.e. a strategy with limited risk as no positions are held overnight. This is the Range Break-out strategy.

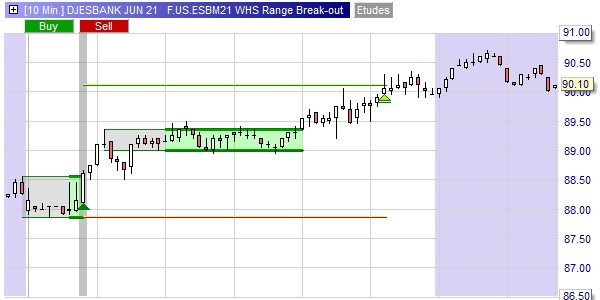

This strategy operates on a 10 minute chart and its signals are only taken between 8am and 1pm. Any position still open at 6pm is automatically closed by the Flat filter. This strategy may seem simple if you judge it by the fact that it has only 4 components.

In reality, this strategy is composed of 4 STARS: the Range Break-out signal, the Range Break-out stop, the Range Break-out target and the Flat filter. These 4 STARS generate signals based on the detection and exit of ranges. Thus, in the following example of a winning bullish trade, the market, which had been stagnant since the previous day, broke out of its range at the top. The price then moved into a new range, before exiting at the top, to meet the target, generating a profit of EUR 80.

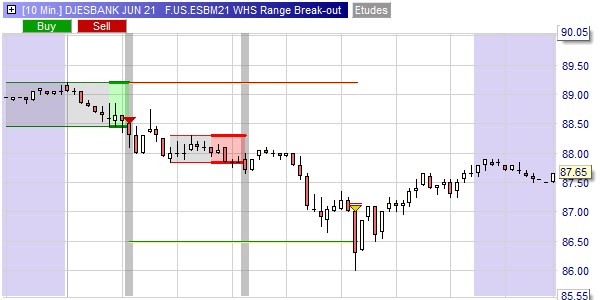

Positions are always framed by a stop and a target. If we take the previous example, the stop is based on the bottom of the range and the target is positioned at 2x the risk. The risk is the distance between the entry price and the stop. In this strategy we also accept sell signals as in the example below.

Not all trades are winners, as in this example, where following a bullish signal, the market moved sideways until it hit the stop, resulting in a loss of EUR 45.

It is notable that this strategy has produced good results since 15 September 2020 as can be seen in the results of a back-test carried out with the components and settings mentioned above. It can be seen that the success rate is relatively high at 56.58% and that the average gain/loss ratio is also very good at 1.23. To top it all off, we have a spectacular benefit factor of 1.60! The profit factor is the ratio of gross profit to gross loss.

Conclusions

The European banking sector is one of the most important sectors of the European economy. It reacts to changes in the political and economic outlook. After hitting its lows, which were harbingers of financial disaster, the DJESBANK European banking sector index has rebounded. This rebound is accelerating since inflation is back in the conversation. For active traders, this is an excellent opportunity to discover the DJESBANK future contract or the CFDs on the alternative ETFs mentioned in the article. These instruments should allow you to take advantage of the expected rise in the European banking sector, either by taking medium-term positions or by adopting the Range Break-out strategy. This day trading strategy has proven its effectiveness since last autumn. Of course, we cannot predict that this effectiveness will continue in the future. However, we can hope that this strategy will continue thanks to the quality of its signals and a few adjustments to be made from time to time.

People also read

Scalping trading ranges with the Sniper