Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

The Dow Theory - The Foundation of Technical Analysis

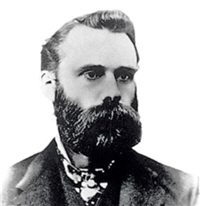

Charles Dow is regarded as one of the founding fathers of classical chart technique. His theoretical model of rising and falling markets has lost none of its validity to this day. In this article we return to Dow's six basic premises. They are somewhat general in nature, but worth reading in order to understand where technical analysis started.

Charles Henry Dow was born in Sterling, Connecticut in 1851. He was an economist and journalist. In 1882, together with Edward Jones, he founded the news agency Dow Jones & Company, which, among other things, published a stock market letter that later became the Wall Street Journal. What information technology is today in terms of importance for the economy, the railway industry was in Dow's lifetime. And so the first index he created included only two manufacturing companies, but nine railway companies. To calculate it, he used the average of the closing prices of the eleven stocks. Dow believed that the performance of this average - as the index - was a good indication of the state of the country's economy. It was not until 13 years later, in 1897, that he decided that two indices - one for industry and one for railways (trasnport) - would better reflect the economy. Dow died in 1902, but his indices remained, and the Dow Jones Industrial Index, which grew to 30 values by 1928 on the initiative of the Wall Street Journal (finally followed by the Utilities Index in 1929), is still the most widely followed stock market barometer in the world today.

The basic premises of the Dow Theory

In 1884, Charles Dow published the first stock index. It was composed of 11 stocks. He later designed other indices and published a series of articles on the behaviour of the stock market in the Wall Street Journal, which he co-founded. He never published a book on his theory. Nevertheless, the development of chart technique and market technique, i.e. the entire technical analysis still used today, was based on his work.

Charles Dow's theories were the subject of numerous books. As early as 1903, one year after his death, "The ABC of Stock speculation" was published by S.A. Nelson, who also introduced the term "Dow Theory". Six core statements by Dow can be exposed.

1. The indices discount everything

The basic principle of technical analysis - it's all in the chart! The assessments of all market participants with regard to the past, present and future, insider knowledge, etc. Unforeseeable events such as natural disasters, terrorist attacks, etc. are also quickly priced into prices.

2. There are three trends in the market

A trend in the Dow sense is a pattern of rising (or falling) relative highs and lows. The graphical connection of the respective lows or highs results in a trend line.

Dow defined three trends, which he compared to the behaviour of water in the oceans. The primary trend represents the ebb and flow of the tide, i.e. it shows the direction in which things are basically going at the moment. The secondary trend represents the waves, and the tertiary trend, which Dow called the "insignificant" trend, corresponds to the smallest changes on the waves. Dow saw the primary trends as lasting from one to several years, and the secondary as corrections of the primary trend (between 1/3 and 2/3 - correction of the previous move) usually at three weeks to three months. The subordinate (insignificant) trend, on the other hand, lasts less than three weeks and hardly played a role for Dow. He was taken with the primary trends.

3. Primary trends are three-phased

Accumulation - public participation - distribution

These are the three phases in a Dow primary bull market. In the accumulation phase, particularly informed or clever investors pick up shares cheaply. A typical case is, for example, the phase at the end of an economic downturn, when in principle all the negative factors are already known. In the phase of public participation, the news situation improves, e.g. at the beginning of an upswing. Trend followers then get on board. Distribution then begins when the mood turns to euphoria. Very high economic growth, strong profit margins, etc. indicate to the smart investors who have been collecting at the low that it is slowly time to get out, especially since the entry of the masses facilitates selling.

4. Indices must confirm the trend

This statement refers to the industrial and railway indices. Dow believed that no general bear or bull market should be declared unless both indices give the same signal, which does not have to be simultaneous, but close in time.

5. Volume must confirm the trend

Volume must be rising in the direction of the primary trend. So if the primary trend is upward, turnover should rise as prices rise and vice versa. If it is downward, turnover should rise when prices fall and vice versa. If this is not the case, the trend must be questioned. For Dow, volume was a secondary indicator, but he paid attention to it.

6. A trend is valid until a definite reversal

Probably the most difficult element in Dow theory. Basically, one should assume that a trend continues until it turns. This corresponds to the physical principle of inertia.

More details on Dow's theory

Charles Dow relied exclusively on closing prices for his analysis. Intraday fluctuations had little relevance for him. The closing price is the essence of the trading day, thus only closing prices could generate signals. Traders may be surprised: But Dow never actually wanted to forecast prices. Instead, he was fascinated to read the future economic development in advance from the prices. He was thus practically the first to discover the stock market as an early economic indicator. Critics today like to accuse Dow or his theory of missing parts of a movement. In fact, the most important signals are generated when previous medium-term highs or lows are undershot or overshot. Then often 20 to 30% of the overall movement is already over. Dow, however, wanted to catch the medium main part, as they make up the bulk, as all today's trend-following models also try to do. So the criticism misses Dow's approach.

Conclusion

Charles Dow is without doubt the forefather of today's technical analysis. He was a visionary and a genius. Not only his insight into human investor behaviour, but also his understanding of the different economic correlations and the factors preceding trends. The most important stock index in the world rightly bears his name.

People also read

- Chart analysis for traders: higher highs & lower lows

- The ABCD pattern goes against the trend

- Andrews pitchfork, drawing the pitchfork correctly

Recommended regulated managed account service